Convertible Bonds

The time for a convertible bond re-rating has come

Convertible Bonds

Our new-year prediction of a strong global convertible bond (CB) supply in 2024 has so far proven accurate. To the end of August, 108 convertible bonds have been issued, totaling over USD63 billion. This puts 2024 on track to surpass 2023, which saw USD71.2 billion raised from 125 deals.

But have the issuances since January 2023 been profitable? Let’s dive into the numbers.

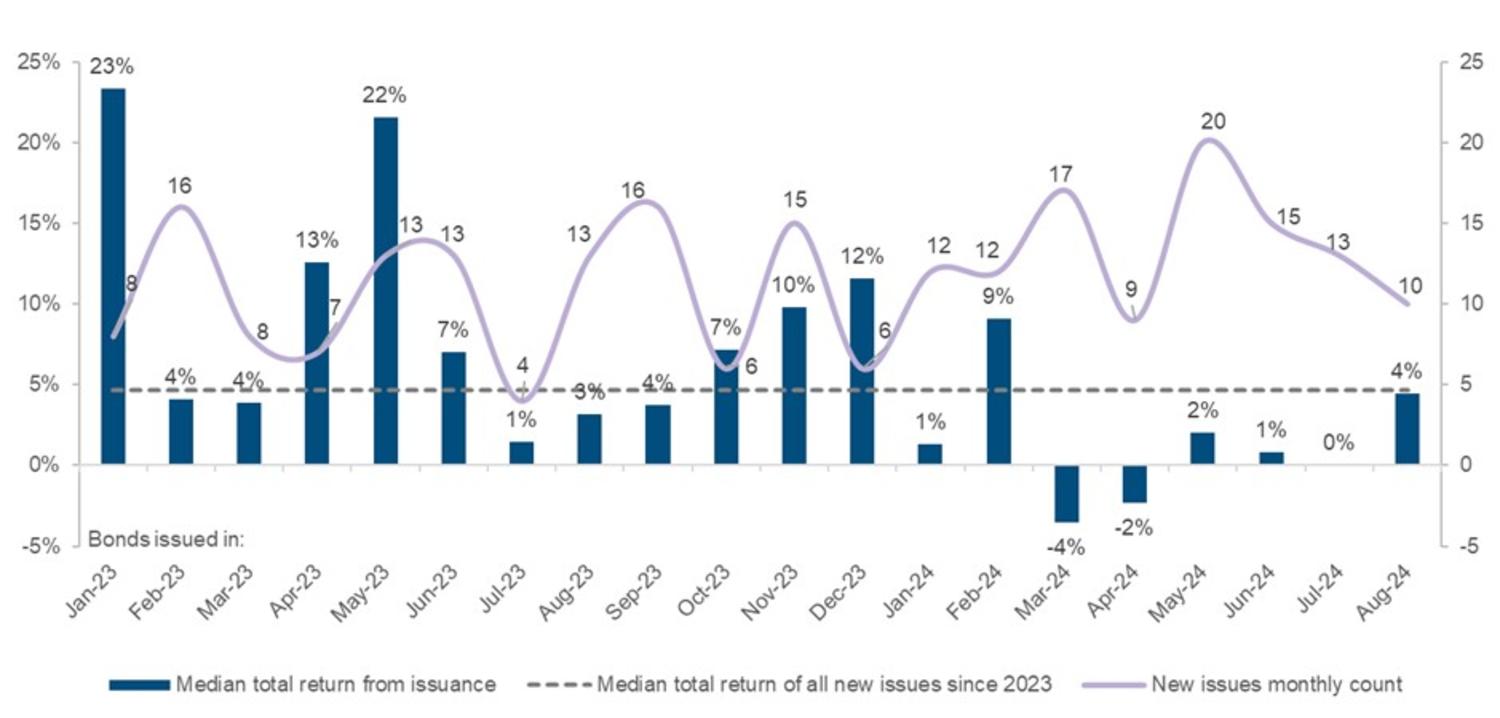

Chart 1 shows the median return of the 233 convertible bonds issued during this 20-month period has been a modest +3.76% to the end of August 2024. While the initial takeaway might be that absolute returns have been underwhelming, we believe the asset class is poised to deliver attractive performance – in our eyes, it’s not a matter of if, but when.

Our confidence is driven by the fact that the equities underlying these convertibles have significantly lagged the returns of the major equity indices, which have been dominated by mega-cap stocks – a group that is largely absent from the convertible bond universe.

A year ago, we expressed excitement over the emerging trends driven by the resurgence of the primary market. The robust pace of new issuances at attractive investor terms is providing fresh opportunities, allowing us to diversify and replace holdings that have become too bond or too equity-like.

Many of these new issues offer both yield and optionality, with yields becoming more appealing as coupons have risen alongside interest rates. Meanwhile, optionality is increasingly attractive as conversion premiums have decreased and single-stock volatility has risen. In short, the convertible bond market is steadily transitioning, replacing poorly structured bonds with more investor-friendly options.

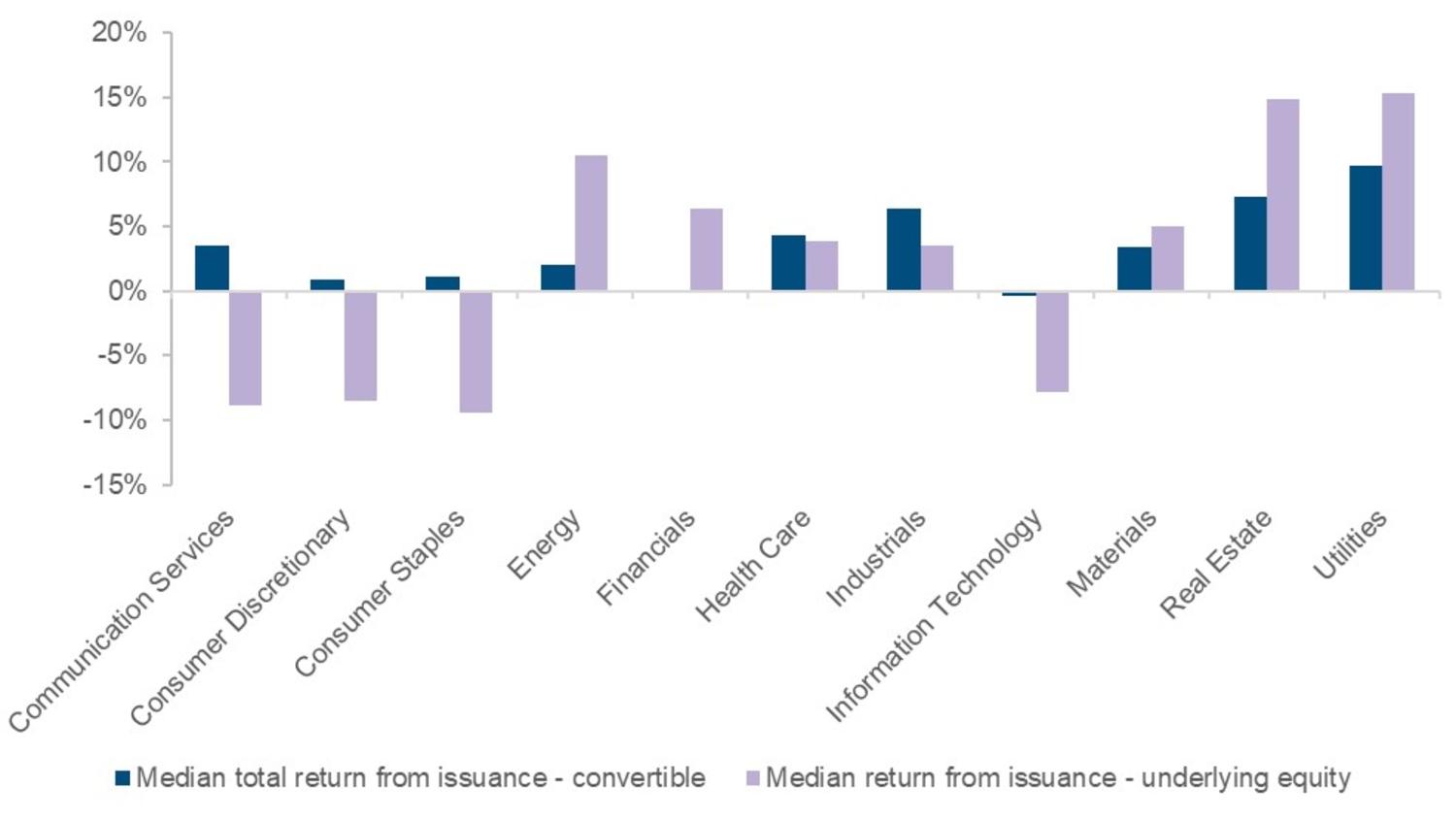

Despite the modest absolute gains from recent issuances, we believe they have more than fulfilled their primary goal: to provide attractive upside/downside capture. This is supported by our sectoral breakdown, where we compared the median returns of convertible bonds to their underlying equities. Our analysis, as seen in chart 2, shows that not only did they achieve significant upside capture, they also demonstrated low downside capture.

The downside resilience can largely be attributed to the repricing of interest rates, which has driven the average convertible bond value to its highest level since 2022. Interestingly, the top performers have traditionally been in defensive sectors like utilities, real estate and healthcare — a surprising result given the typically bullish market environment.

We believe that new issuances offer compelling dip-buying alpha opportunities in the underlying stocks of select issuers, particularly in sectors like consumer discretionary, staples, communication services and IT. Many of these stocks have experienced significant sell-offs and have not yet fully recovered on an absolute basis, presenting attractive entry points.

While the CB asset class has lagged the traditional 60/40 equity/bond portfolio in terms of returns, we remain confident in its potential. We believe current market conditions are too favourable to overlook.

Today’s evolving CB universe offers improved convexity and provides valuable exposure to small-cap stocks – which we find particularly appealing.

We believe that convertibles are laying the foundation for attractive returns over the next 12–36 months. While we anticipated that the path wouldn’t be linear, we underestimated the early signals of a potential central bank rate cut cycle, which could unlock significant upside. Additionally, we foresee the next leg of equity market leadership coming from small and mid-cap stocks – a segment that has seen nearly half of its new issuers tapping into the convertible bond market.

This reinforces our focus on identifying rotation opportunities. The potential for an earnings inflection further supports our decision made last March to gradually shift our overweight exposure to small caps, after favouring large caps for the previous two years. It’s only been six months, but we believe we are getting closer to small caps reclaiming market leadership.

Convertible Bonds

CONVERTIBLE BONDS

Continue to