Equities

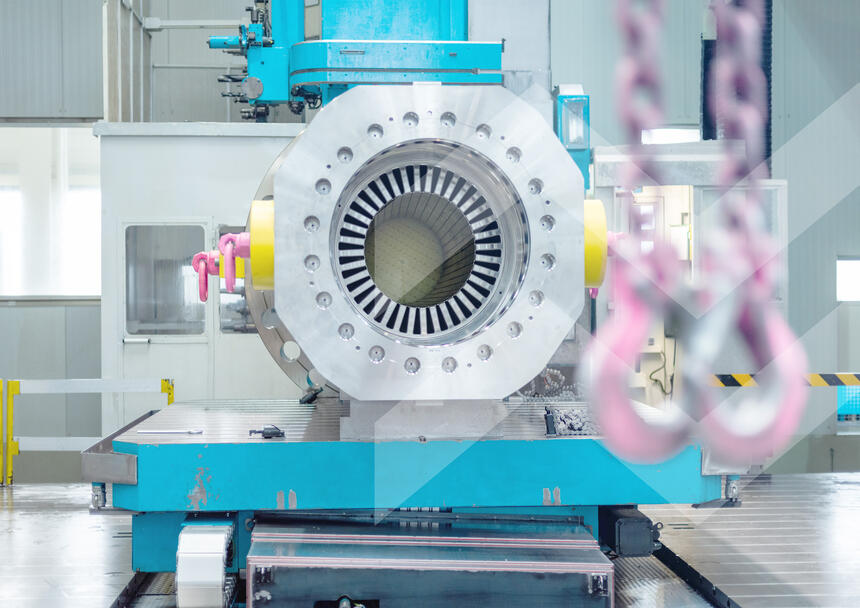

Sometimes a picture says it all. Below is a photo from a recent research trip we took to Germany that perfectly illustrates the market opportunity: underneath the surface detritus is one of the world’s best high-performance vehicles that someone has forgotten to love.

The multiple macro and geopolitical headwinds faced by Germany have created a lot of surface noise, but under the bonnet, there are some amazing businesses. Like the rest of Europe, Germany offers investors some extreme value opportunities; it is currently one of the cheapest markets in the region.

Our investment approach is based on discovering under-the radar small-cap companies that offer both attractive portfolio diversification benefits and the potential for double-digit returns. We have been deeply analysing the German market and buying into some great businesses at incredible prices. KSB provides an excellent example.

KSB is an industrial pump-maker founded in 1871 and based just outside Frankfurt. The company upholds the adage that if you want something built, Germany is one of the best places to go. Quality is king in all the sectors KSB serves, but the stakes are extra high in its nuclear division, where the water temperatures involved are so high that if a pump fails it can cause a critical event. KSB is the world’s leading pump supplier to nuclear power stations, highlighting the quality of its technology and products.

Alongside functionality, it also does suitability very well. Across the industries KSB supplies, water is an increasingly precious resource. Pumps are critical for using water most efficiently – getting fresh water where it needs to be and ensuring wastewater is moved to safe discharge zones. Wastewater is the second-biggest division at KSB. In the mining sector, a replacement cycle is underway to implement ‘smart’ pumps that are more water and energy-efficient. Energy efficiency is paramount in nuclear due to the amount involved in the processes and the global need to reduce emissions. 40% of the lifecyle costs of a pump are energy1.

KSB exemplifies the type of company we target in our Discovery strategy: a true smaller company with a market cap of EUR1.4bn. The stock is unloved with only three local bank analysts covering it, making the valuation very attractive if investors return to Germany.

So what’s next for KSB? The big focus is to expand from only selling pumps to providing long-term product maintenance services – these are higher margin and give the firm good visibility beyond the initial equipment sale. Customers typically pay c.9x the price of a pump in servicing and parts. From our perspective, the servicing model can expand the margin in the business. The model is made more robust by the increasing complexity of pump technology, reflecting the influence of the IoT. The pumps are becoming less mechanical and increasingly computer-based, driving up the need for propriety servicing support and keeping the client within the KSB ecosystem well beyond the point of sale.

KSB is currently a top holding in the strategy that has been a strong contributor to returns and makes the case for why in European equities, small can be beautiful.

1 KSB internal figure

European Discovery Stories

European Equities

EUROPEAN EQUITIES

IMPORTANT INFORMATION

This marketing material is for your exclusive use only and it is not intended for any person who is a citizen or resident of any jurisdiction where the publication, distribution or use of the information contained herein would be subject to any restrictions. It may not be copied or transferred.

This material is provided for information purposes only and shall not be construed as an offer or a recommendation to subscribe, retain or dispose of fund units or shares, investment products or strategies. Potential investors are recommended to seek prior professional financial, legal and tax advice. The sources of the information contained within are deemed reliable. However, the accuracy or completeness of the information cannot be guaranteed and some figures may only be estimates. In addition, any opinions expressed are subject to change without notice.

All investment involves risks, returns may decrease or increase because of currency fluctuations and investors may lose the amount of their original investment. Past performance is not indicative or a guarantee of future returns.

This communication may only be circulated to Eligible Counterparties and Professional Investors and should not be circulated to Retail Investors for which it is not suitable.

Issued by: in the UK: Mirabaud Asset Management Limited which is authorised and regulated by the Financial Conduct Authority. D14 In Switzerland: Mirabaud Asset Management (Suisse) SA, 29, boulevard Georges-Favon, 1204 Geneva. In France: Mirabaud Asset Management (France) SAS., Spaces 54-56, avenue Hoche, 75008 Paris. In Luxembourg, Italy and Spain: Mirabaud Asset Management (Europe) SA, 6B, rue du Fort Niedergruenewald, 2226 Luxembourg.

Continue to

Equities