Fixed Income

Fallen angels: flight path to outperformance?

Fixed Income

Fallen angels have recently ascended to saint-like status in the eyes of some fixed income investors.

A fallen angel is a bond that is downgraded from an investment-grade (IG) rating to high yield (HY). While sounding negative at the headline level, the downgrade can create opportunities for investors with the flexibility to invest across the credit spectrum.

The bond’s move down the rating categories can result in price dislocation, as investors who can only hold IG become forced sellers, widening the bond’s spread versus similarly rated peers. We’re not seeing as much forced selling as was the case historically, as more investors opt for unconstrained fixed income strategies, but nonetheless, it still occurs to a degree.

Fallen angels also have the potential to rebrand as ‘rising stars’ – where they regain their IG status, pricing higher as a result. In this scenario, the issuer company has typically been downgraded for a specific reason, quickly makes changes to address it (such as issuing equity), or the macro environment shifts significantly, and its results improve. Its shelf life as HY company is short.

Identifying the fallen angels that quickly convert to rising stars is perhaps the ultimate HY trade. Conversely, holding bonds that continue to be downgraded – so-called ‘falling knives’ – represents the downside of angel ownership.

In between the star ‘winners’ and the knife ‘losers’ is the common outcome for a fallen angel bond. Here, the rating downgrade is usually driven by the company holding too much debt or the sector being in collapse and leverage goes up – these types of scenarios take a long time to unwind, the bond loses its angel accolade and becomes a normal BB.

From our perspective, fallen angels can generate returns when they come good, but that doesn’t happen all the time. They only really perform during specific points in the economic cycle.

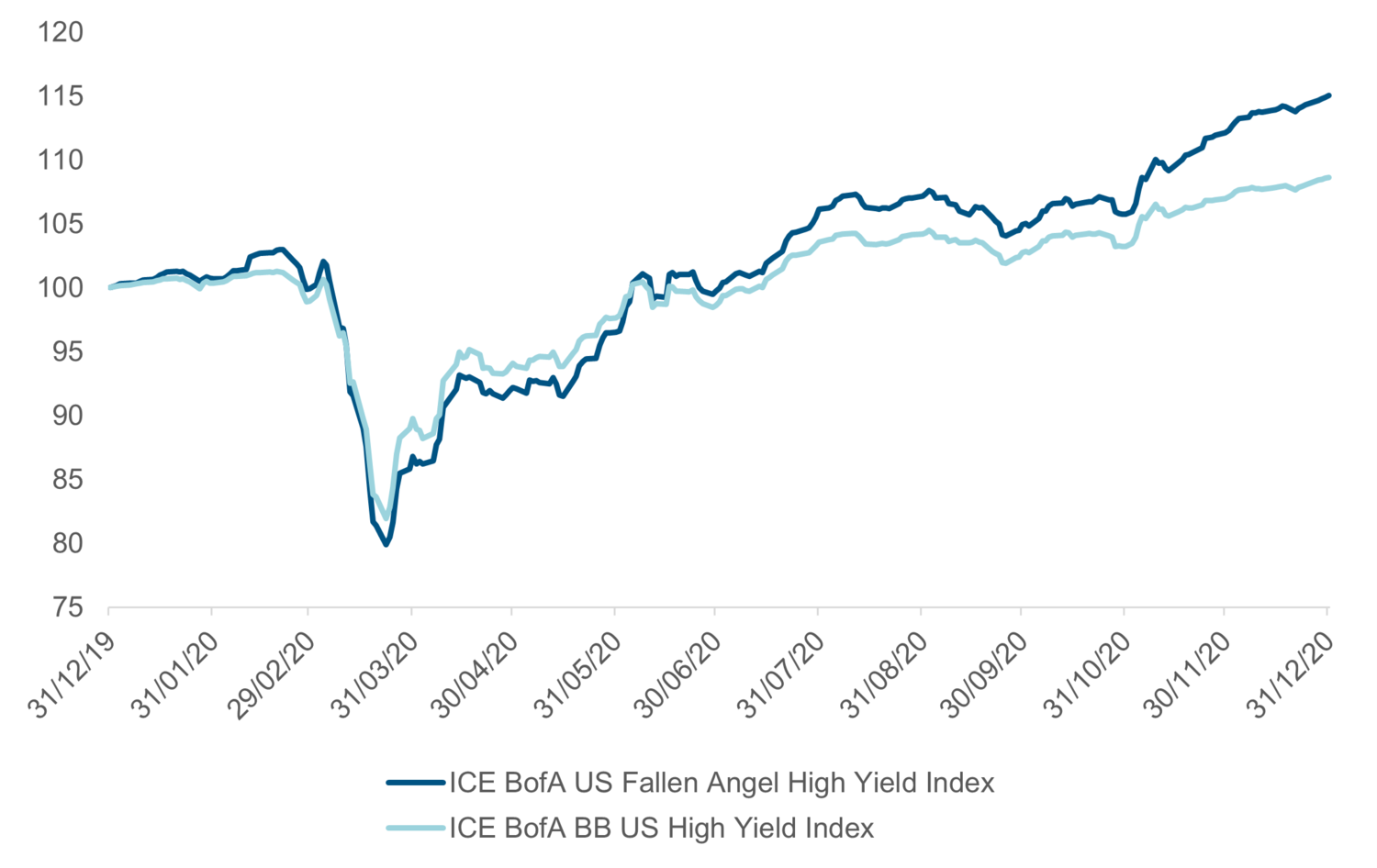

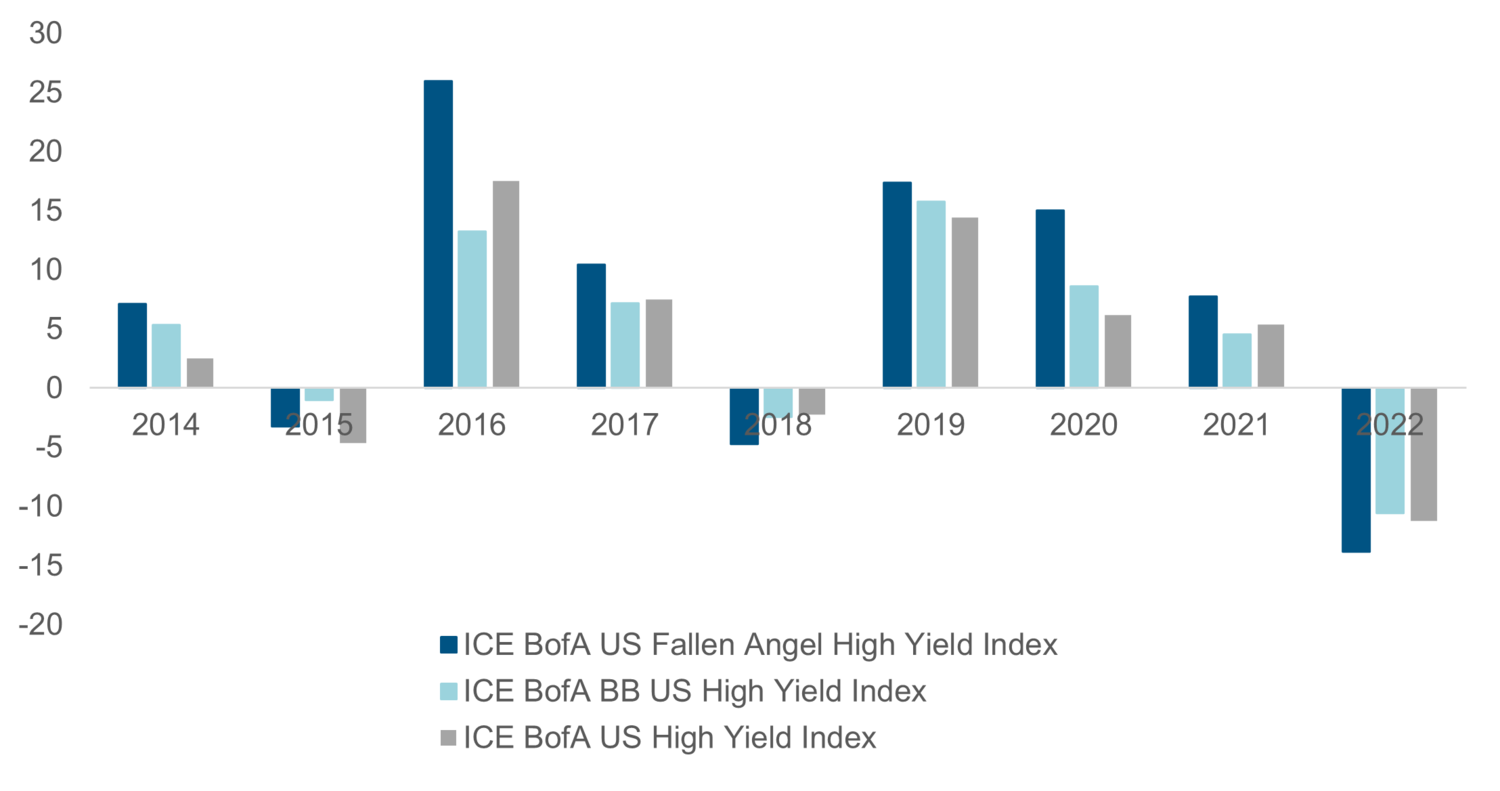

In the period immediately following a large influx of fallen angels into high yield – essentially, during an economic crisis – we often see outperformance. Notable examples are the global economic slowdown of 2016, where US fallen angels returned 26.0% versus 13.2% for US BBs and 17.5% for the US HY market as a whole, and the peak of the Covid pandemic in 2020 (15.0% vs. 8.6% & 6.2% respectively).

In both examples, the global economy slowed down and IG companies suffered downgrades. These bonds are long duration, low coupon with a low cash price. They were bought by HY investors as the highest-rated bonds in the asset class. When the economy recovered, they rallied back to prior levels with a number upgrading to IG as rising stars.

Source: Bloomberg, 29 June 2023

As we move through the cycle towards recovery, lower-quality credit tends to outperform, with the longer-duration, higher-quality credits underperforming, especially as you hit late cycle, such as in 2018, when US fallen angels returned -4.7% on the year versus -2.4% for US BB and -2.2 for US HY as a whole. Similarly in 2022, US fallen angels returned -13.9% versus -10.5% and -11.2% for US BB and US HY respectively.

Source: Bloomberg, 29 June 2023

The data shows a clear pattern: in down years for HY, fallen angels underperform standard BBs, and in the years following the end of a cycle with a new cohort of fallen angels, they outperform.

Source: Bloomberg, 29 June 2023

We’re still not certain that we have reached the end of the cycle, leaving fallen angels vulnerable to underperformance. And with companies more operationally agile and more conservative having learnt lessons during the pandemic, we may not get the wave of downgrades to stimulate outperformance on the way out of the next downturn.

Given they only make up 7% of the US HY index, our view is that fallen angels sit best as tactical trade within a globally diversified HY portfolio, rather than as a dedicated strategy. We believe strategies that are fully flexible and willing to use credit quality as a clear active lever will outperform over the long term.

Continue to