Convertible Bonds

The asymmetric return profile of convertibles is getting stronger

Convertible Bonds

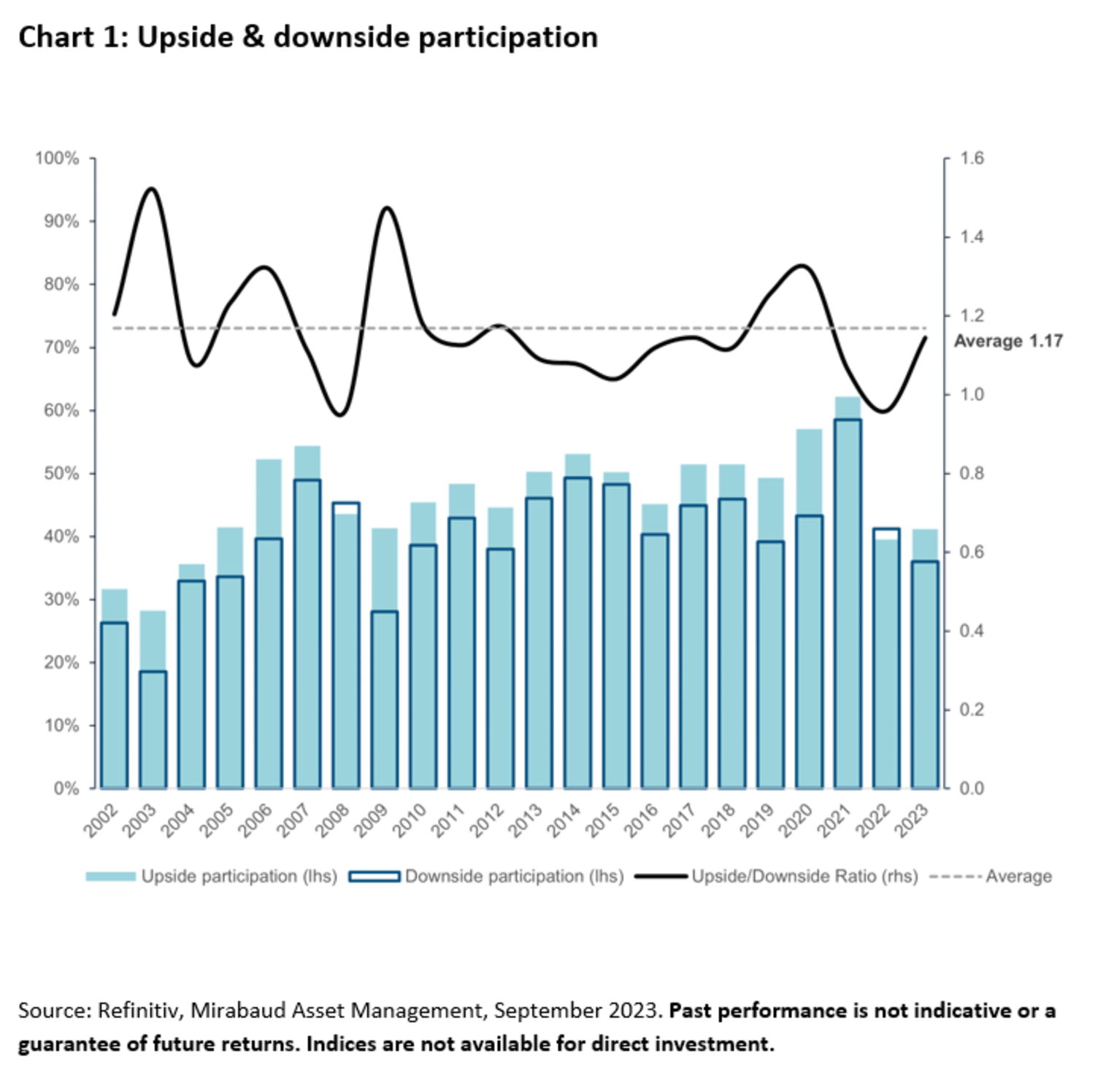

When looking at asymmetry, the objective is not to think forward, as we often do using market-driven scenario analysis, but to look backwards, measuring the participation rate of convertible bonds’ price variations to their underlying equity moves. To do this, we can use the values of the Refinitiv Global Convertible Bonds Index hedged in USD and its parity.

As shown in chart 1, the average upside participation has been 47% since 2001, with a peak at 62% reached in 2021 and a low of 28% hit in 2003. Opposingly, the average downside participation has been 40% over the period, with record highs and lows reached in the same years as during the upside participation highs, at 59% and 19% respectively.

While the absolute levels of participation by global convertible bonds (CBs) are ultimately driven by their delta levels, the ratio of how much of their underlying stocks’ performance they capture on the upside compared to the downside is an interesting guide for investors looking to evaluate the asset class’s risk/reward profile. In fact, the upside/downside participation ratio has improved meaningfully this year at 1.14%, having reached a record low in 2022 at 0.96%.

We think this positive reversal should continue to trend upwards, reflecting the current characteristics provided by CBs, as highlighted in our article “Convertibles combine the best of both worlds, again”.

With the asymmetric return profile of the asset class getting stronger, now seems an opportune time to consider why convertible bonds are an attractive defensive alternative to equities.

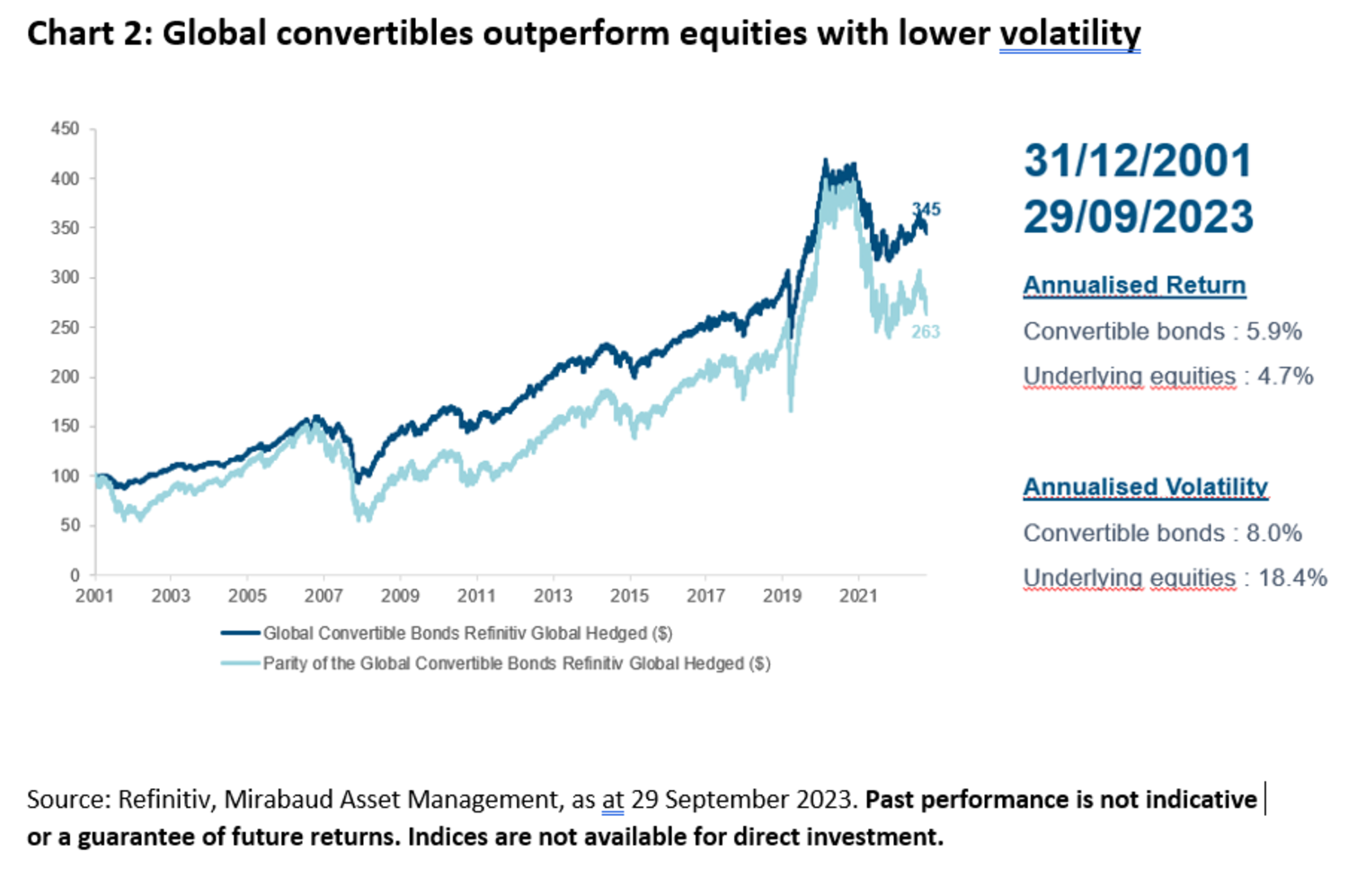

Chart 2 shows that the broad CB market has outperformed the underlying equities (5.9% vs 4.7% annualised returns) with notably lower risk (8% annualised volatility vs 18.4%) since 2001.

Examining the chart over time, it seems clear to us that the long-term convexity of the asset class played a significant part in this standout performance. From the Lehman collapse in 2008 to the end of the pandemic in 2021, CBs rose with equities, and their participation rate increased alongside. The fact that each CB has a limited life also helped to lock in gains, as many of the bonds were not redeemed but converted at prices well above 100%.

This is the same as saying that the profits on these positions have been achieved and cannot be reversed when the market moves in the opposite direction. As such, when markets peaked in 2021, CBs started to fall with equities, but the participation rate declined over time.

Furthermore, we have learned from previous cycles that the CB market tends to recover before equity markets post their lows, as the discounts start to correct and CBs tend to start from a higher base than equities when a new cycle begins. The idea is not to speculate on starting a new cycle, but to recall that CBs’ future performance is supported by valuations, as highlighted in this article.

Some CBs are currently trading below their bond value while there is a tendency for the market valuation to normalise on its own as the individual bonds expire. In a similar way, companies that use market dislocations to buy back their own bonds contribute to normalisation.

Finally, an additional mechanism that we feel would help the CB market to participate in any upturn that may come is the primary market, which brings new issues with an average delta of 50% and extends the life to maturity of the universe.

These arguments reassure us of our belief that the upside/downside participation ratio will likely continue to improve over the coming year. If the market remains under pressure, the current breakdown by technical profile (55% bonds / 36% balanced / 9% equity) should provide a more stable risk-return path than experienced in 2021 and 2022.

For those investors who continue to believe that the market outlook remains uncertain, CBs offer, in our view, an attractive option to still participate in equity market gains if markets recover further. Meanwhile, they also offer a degree of capital protection and diversification in the context of a global portfolio.

Convertible Bonds

CONVERTIBLE BONDS

With the asymmetric return profile of the asset class getting stronger, now seems an opportune time to consider why convertible bonds are an attractive defensive alternative to equities.

Continue to