Equities

Investing in consumer power

Equities

The Millennial consumer has been a long-standing investment theme for us. Born between 1980 and 1994, this demographic, which makes up the largest proportion of the US population at some 72 million1, is the driving force behind global consumption patterns.

While the baby boomers (1944 to 1964) were the most successful generation in terms of accumulating wealth, Millennials have graduated into their prime earning years, which gives them unrivalled spending power. They are set to account for 75% of the global workforce by 2025, with a combined income of USD8.3 trillion2.

What Millennials spend on matters for business, the global economy and equity investors. Popular Millennial spend areas include skincare and cosmetics, healthcare, fitness and take-away coffee.

Our thematic investment strategy focuses on innovative companies that recognise the collective power of the Millennial consumer and are evolving their business strategies to capture the revenue potential in this market.

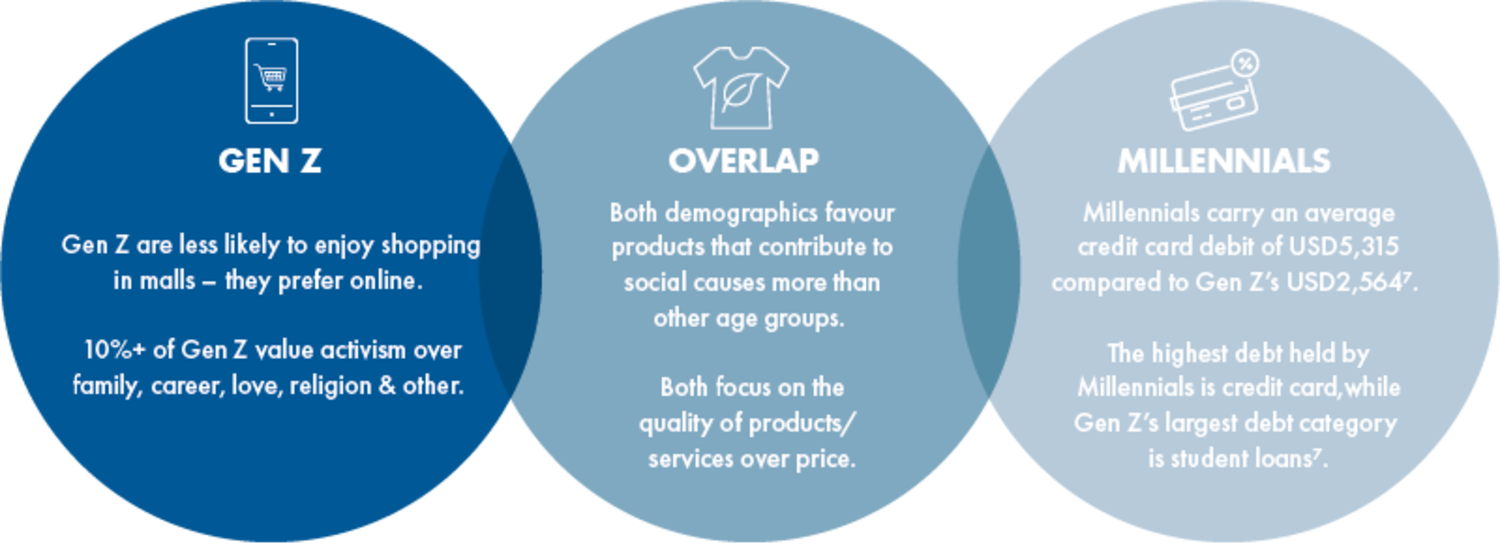

Hot on the heels of their Millennial siblings are Gen Z – the socially conscious, digitally dependent, self-proclaimed ‘citizens of the world’. Born between 1995 and 2015, and therefore growing up fully online, the world’s 2.5 billion Gen Z-ers3 are now entering the workplace with a bang, imploring older generations to technologically adapt to their level.

According to BofA research, Gen Z is set to become the most disruptive generation to economies, markets and social systems. As such, we see significant potential investment value in Gen Z and are broadening our thematic Millennial consumer focus to include both demographics.

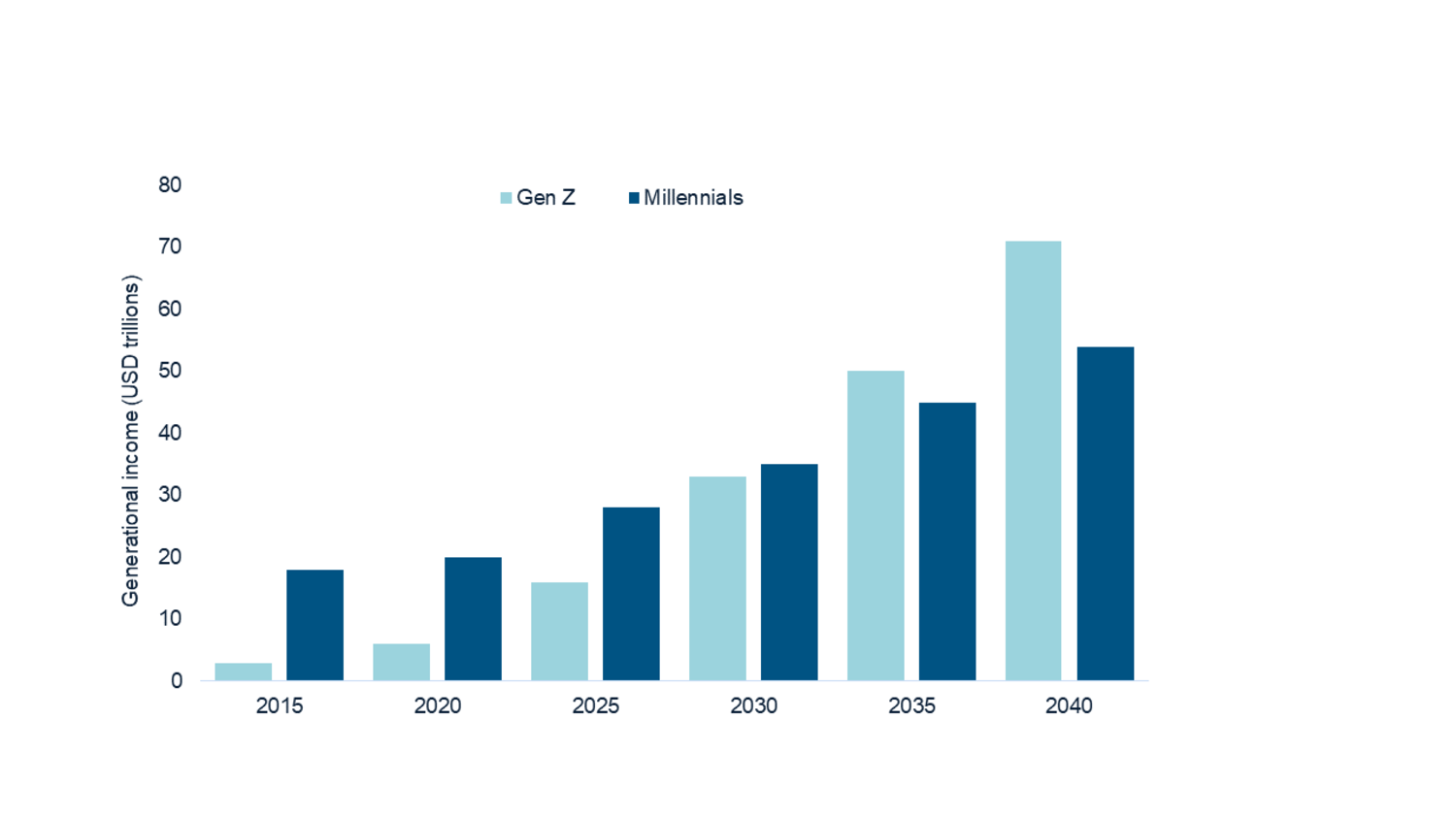

While Millennials are the top spenders today, Gen Z’s economic power is the fastest growing of all the demographic cohorts. The group’s income is set to grow 5x by 2030 to USD33 trillion, or 27% of global income4.

With the fledgeling salaries they are making today, Gen Z like to consume sustainably, with climate change heavily influencing their choices; they embrace new technologies and cryptocurrencies, and they favour products over experiences.

As their income increases, we expect Gen Z to drive e-commerce development, sustainability and fashion trends. Their insular nature (they like to spend their time in the online world, with 40% preferring online over in-person interactions with friends5) lowers their interest in travel and eating out. But they still like to status signal via social media, using online second-hand marketplaces to obtain luxury in a sustainable way, which has the knock-on impact of strengthening the resale market for the brands loved by their Millennial siblings.

Geographically, emerging and developing markets are the mecca for Gen Z. 89% live in EM6, with India being an economy to watch due to the rapid development of the country’s technological infrastructure, expanding urbanisation and improving literacy rates.

Source: Euromonitor, November 2020

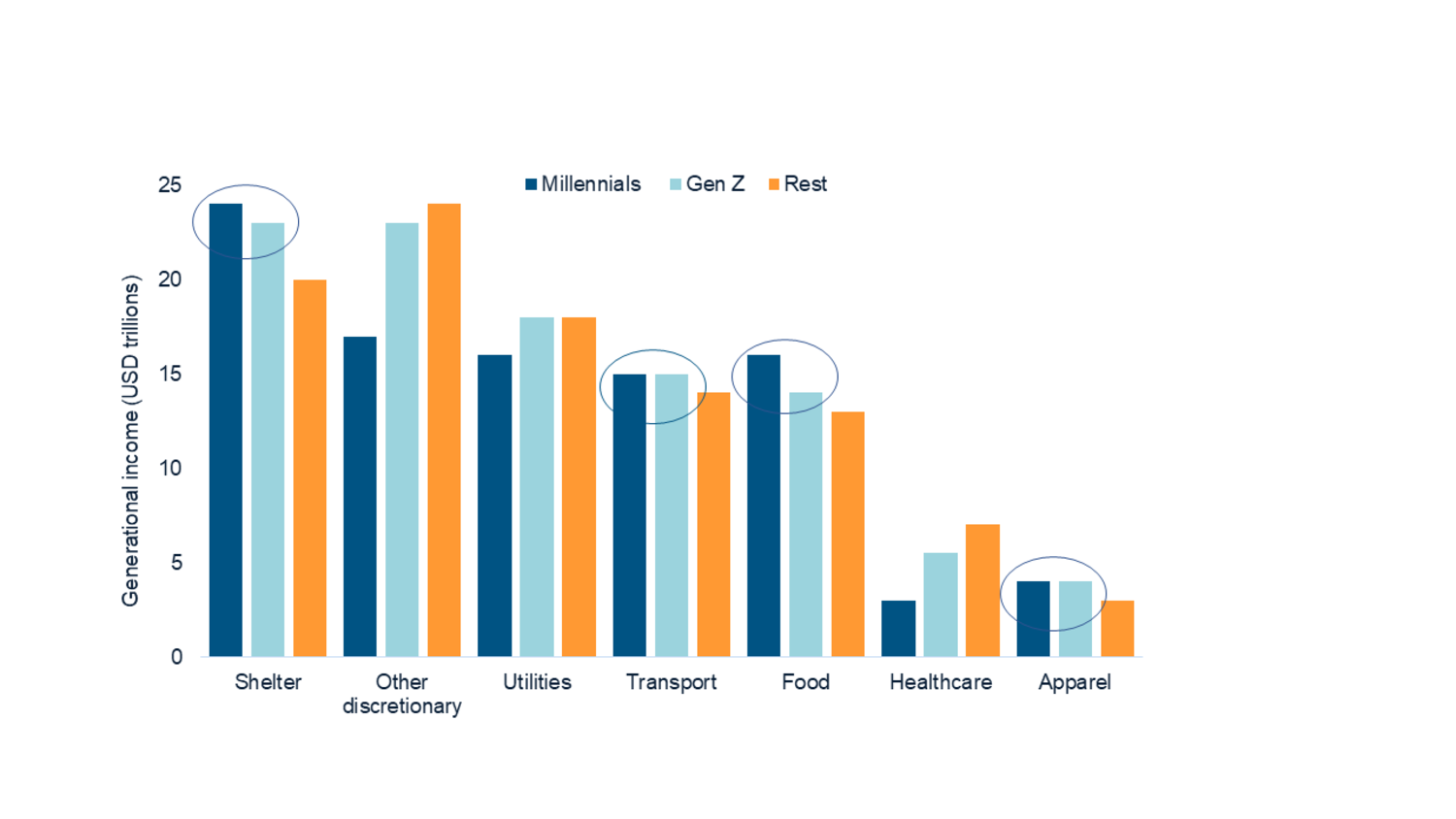

Source: Haver Analytics, Morgan Stanley Research forecasts, August 2019

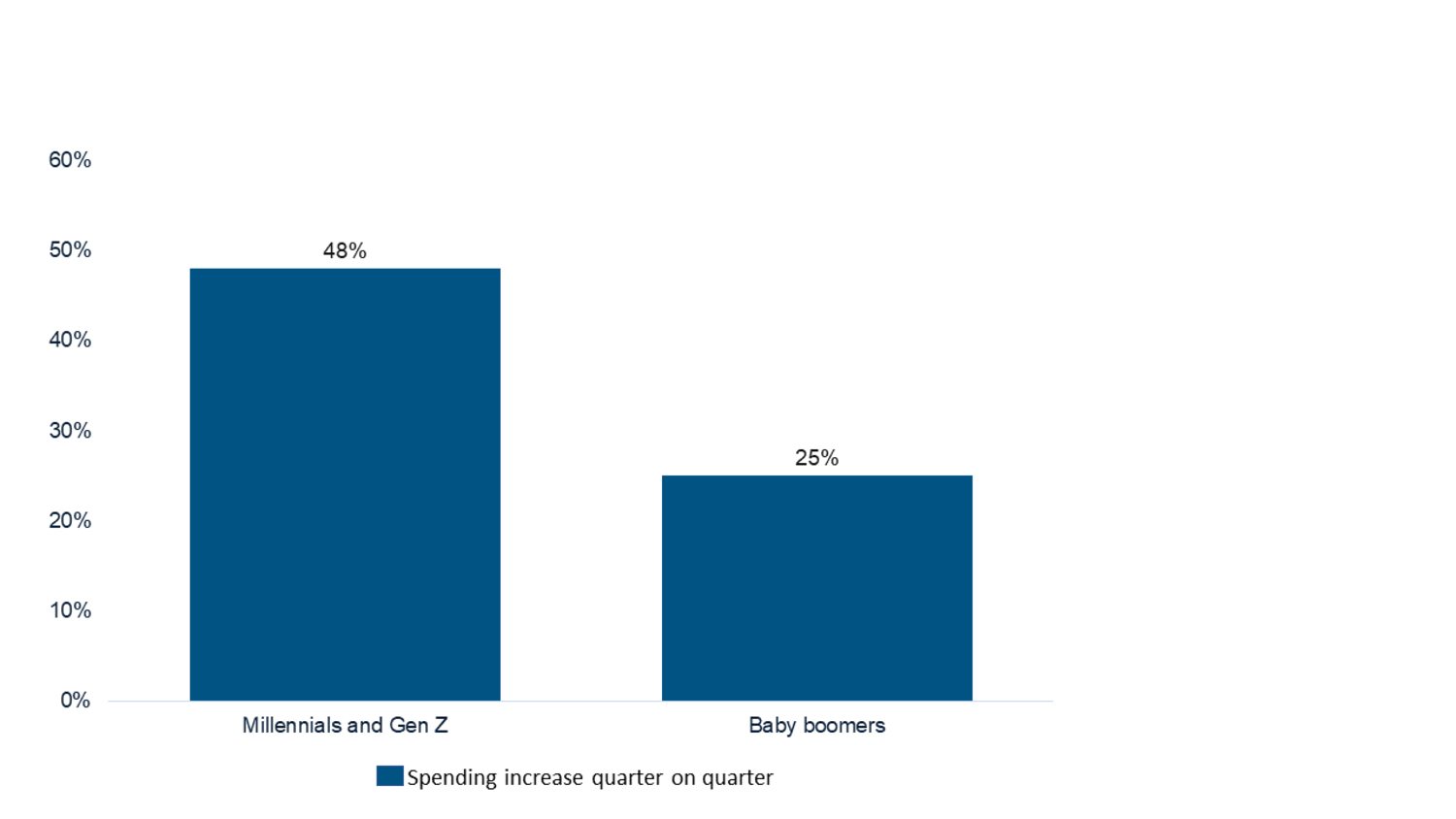

Millennials & Gen Z accounted for 60% of new Amex cards in 2021

Source: American Express, 2021

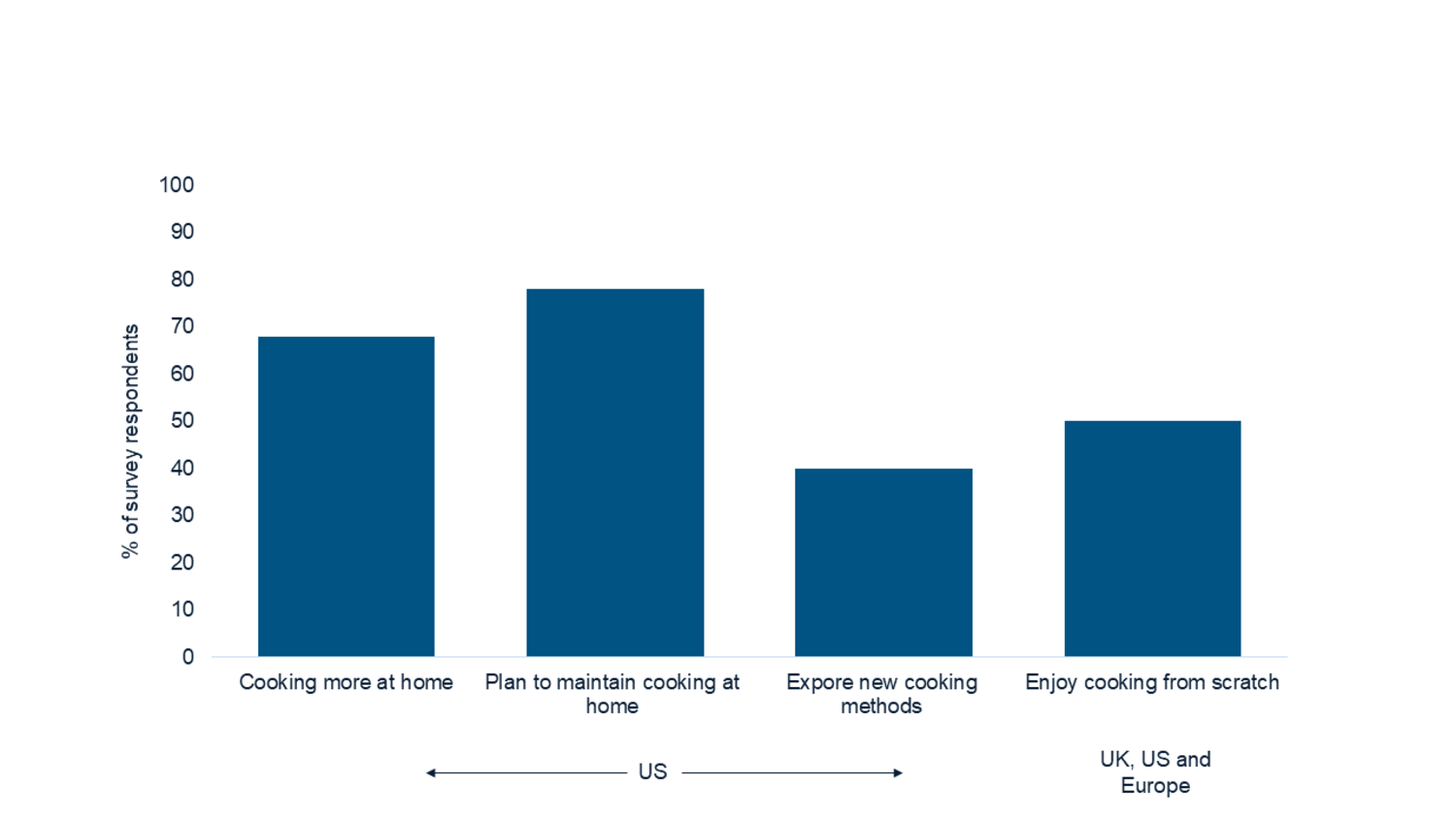

Sustained increase in cooking at home post the pandemic

Source: Spendmenot.com, January 2023

IS TWO TOGETHER BETTER?

We believe so, yes. The Millennial consumer is an established investment theme for us and one we see offering return potential for several years to come. But our investment style focuses on backing high-conviction ideas and owning companies for a long period of time.

We believe considering the impact Gen Z will have on the global economy as they come to full spending power creates significant medium to long-term investment potential. And while they have their differences, the two groups have similar spends for shelter, transportation, food and apparel.

We expect Gen Z to add momentum to some of the trends started by Millennials, such as the demise of old media.

Source: Mirabaud Asset Management, January 2023

1 Statista, October 2022

2 BofA Global Research, November 2020

3 4 5 BofA Global Research, November 2020

6 BofA Global Research, November 2020

Equities

Download the full article here

Continue to

Equities