Convertible Bonds

Takeover activity is a structural tailwind for convertible bonds

Convertible Bonds

M&A was a prominent theme during 2022, with the convertible bond (CB) asset class accounting for 13 takeovers, including Zynga by Take-Two, Nuance Communications by Microsoft and Mandiant by Alphabet, all of which generated significant returns for investors.

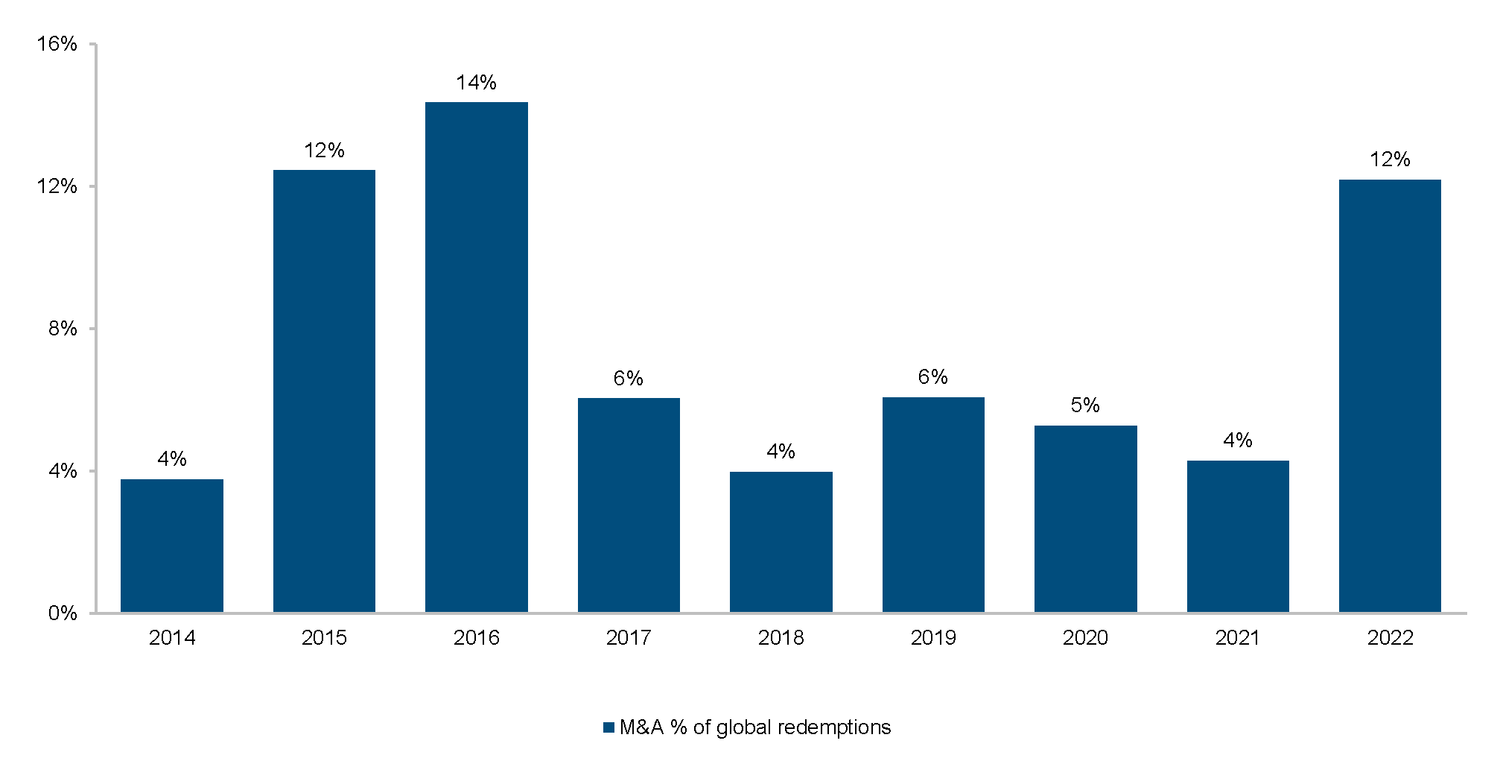

According to BofA Global Research, the average performance of all CBs that were taken out in 2022 was nearly 23% from their pre-deal price to their final price, while 12% of all global CB redemptions have been due to takeovers ─ a six-year high (see chart 1).

Chart 1: M&A portion of global CB redemptions

Source: Bank of America, Mirabaud Asset Management as of 31 December 2022.

It’s important to remember that CB holders generally benefit from some form of takeover protection by two standard clauses, which are triggered by a change of control:

1. The “ratchet clause” increases the conversion ratio, which compensates investors for the loss of value time. Ratchets are most profitable for convertibles trading at the money or in the money, and when the maturity date is distant, such as the 1.875% 2028 issued by the biopharmaceutical company Global Blood Therapeutics. The bond gained 79% last summer following the company’s acquisition by Pfizer.

2. The “put clause”, which allows the right to put back the convertibles for cash at par. Puts are beneficial for out of the money convertibles trading below par, such as the business software provider Avalara, acquired by Vista Equity Partners, which pulled-to-par its 0.25% converts from the low 80s.

The outlook for this year is no less promising in our view, given the dominance of technology, consumer discretionary and healthcare sectors in the asset class.

The global convertible market has a variety of issuers that represent prime takeover candidates, which motivate us to screen for potential alpha opportunities arising from event risk. That’s why we usually look to estimate an acquisition price based on the company's fundamentals, then assign a probability of a transaction and model the expected value of the convertible accordingly.

In some instances, high profitability in the event of a change of control might be partially reflected in the CB valuation, especially for issuers connected to takeover rumours or speculation, such as Cellnex and Rapid 7 in January 2023.

We expect M&A activity affecting convertible bond issuers to remain robust because innovation encourages industry consolidation.

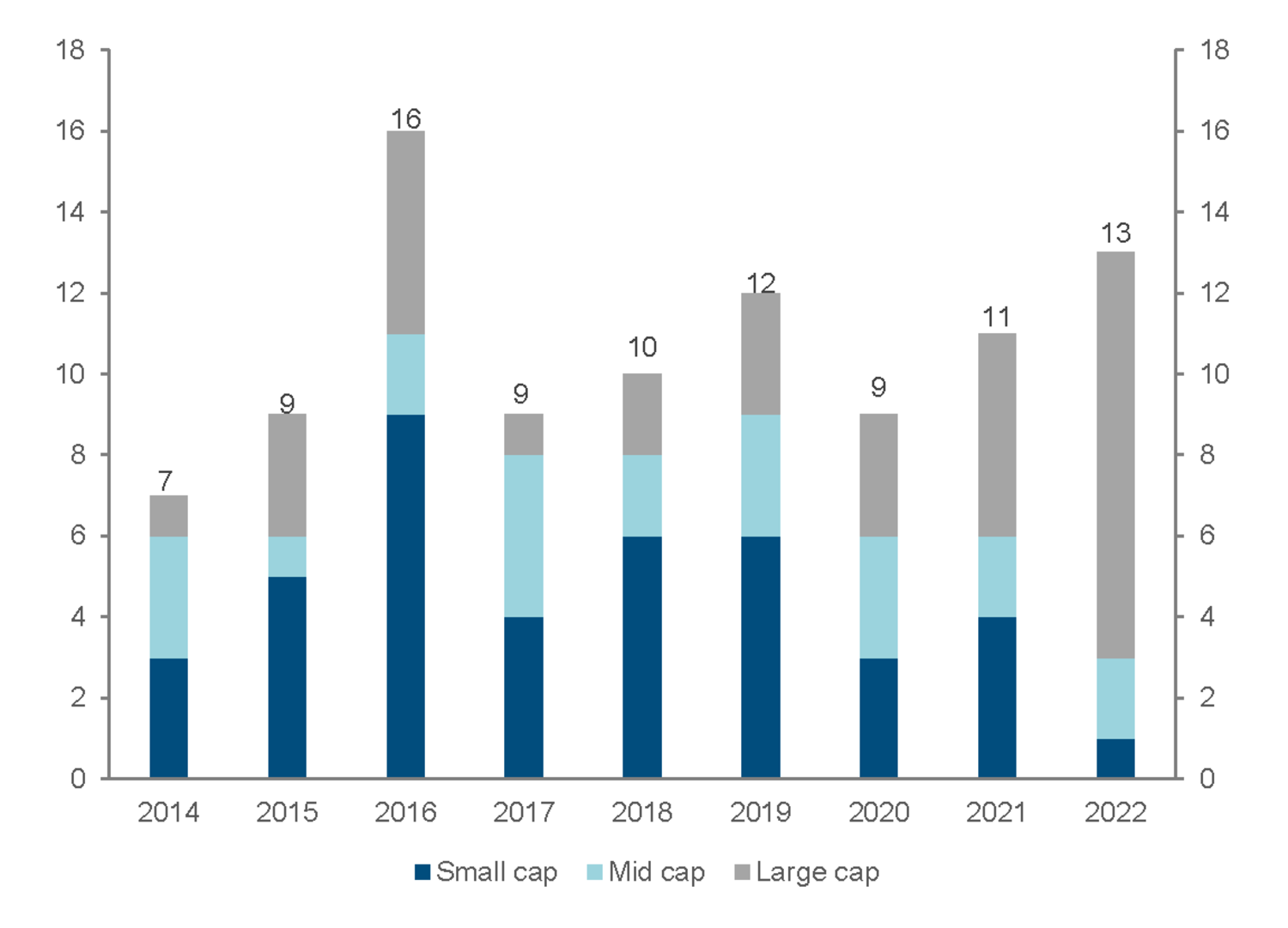

The asset class is likely to be well represented due to the high proportion of small and mid-cap issuers (below USD5bn market capitalisation) in the convertible mix, which represented 65% of takeover targets over the period 2014-2022 in the global CB universe (see chart 2). Those disruptive companies often have no other debt instruments available to them and provide exposure to some important secular trends serving large addressable markets.

Chart 2: Historical M&A activity

Source: Bank of America, Mirabaud Asset Management as of 31 October 2022

Continue to