Convertible Bonds

Convertibles combine the best of both worlds, again

Convertible Bonds

What will occur over the upcoming weeks cannot be predicted by anyone, but one thing is for certain…convertibles are back in high-convexity territory.

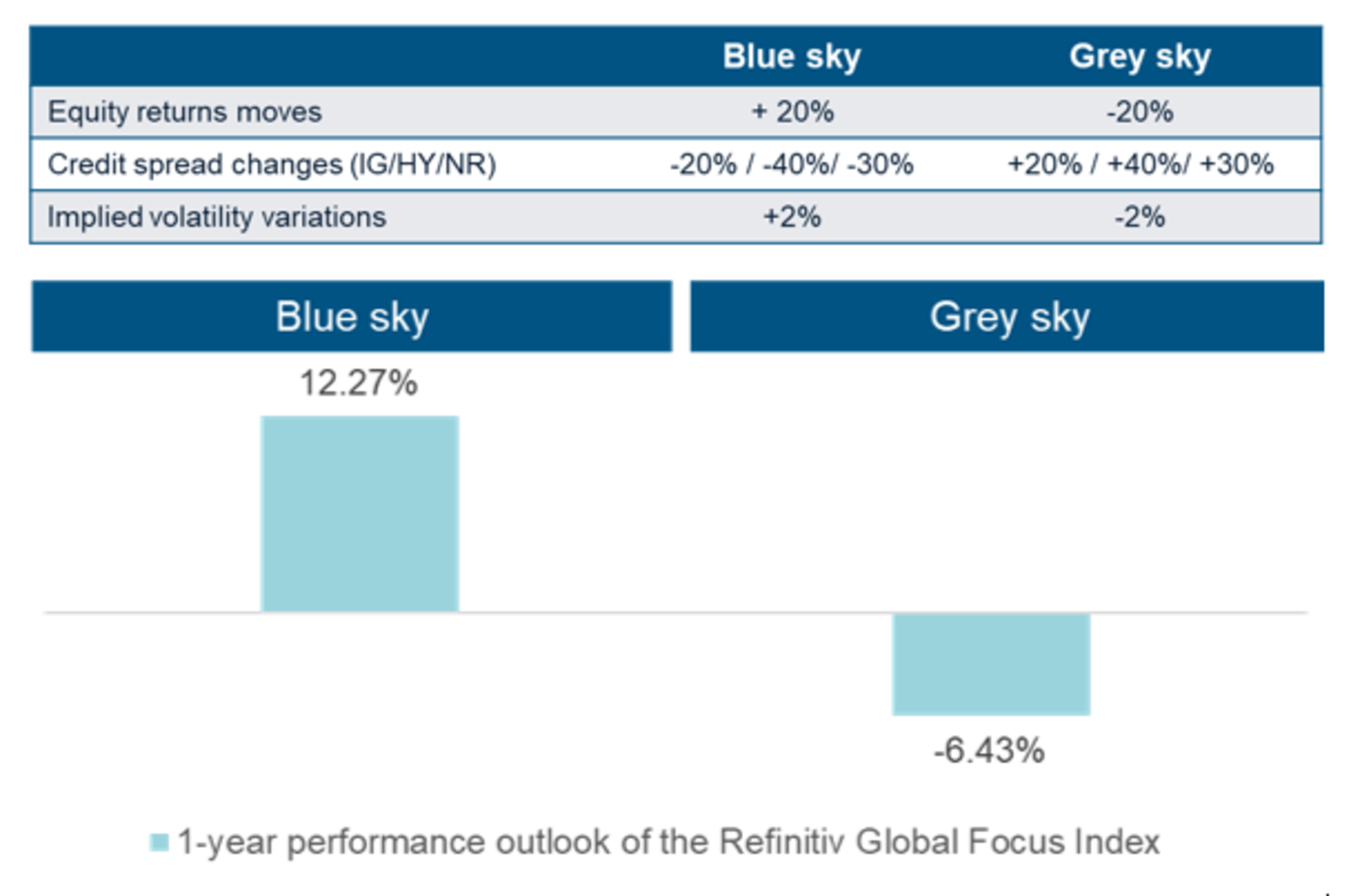

To illustrate this good news, we have estimated the 1-year return of the Refinitiv Global Focus Convertibles Bond Index (hedged to USD) under two scenarios, by combining the three main performance drivers of the asset class: equity returns moves, credit spread changes and implied volatility variations.

Blue sky & grey sky scenarios

Source: Mirabaud Asset Management, Leversys as of 30 June 2023. 1-year return takes into account maturity and put option and includes coupon, exchange gain/loss.

From these numbers, we conclude that convertible bonds remain a desirable investment opportunity in the current uncertain market environment, as they typically provide a greater degree of outperformance during market downturns (13.57%) than underperformance during market upturns (7.73%).

However, it is important to note that convexity is not a guarantee of positive returns or protection against losses. Performance remains dependent on various factors, including the specific terms of the bonds, market conditions and the financial health of the issuer.

This is the rationale behind our belief that an active, benchmark-agnostic approach can optimise the outcome and provide investors with a notable edge over passive approaches, by offering the flexibility to handle shifting market conditions, as well as to search for alpha.

After 2.5 years of relative underperformance compared to other risk assets, including equities and credit, we encourage investors to be forward-looking in their thinking and consider the seven tailwinds we have identified for convertible bonds:

“Paid to wait” is the new paradigm with 72% of convertible bonds currently yielding positively. We would expect this factor to contribute positively if recession fears increase, as interest rates would likely decline, leading to a rise in bond values and possibly price appreciation.

The asset class is well suited, in our view, to providelower downside risk than equities in the event of a return of volatility, because the average delta of the universe is in the sweet spot at 45%.

The primary market is back and appealing in 2023. Over the first half of the year, we saw 78 new issues totalling USD39.2bn, with an average coupon above 3% from financially stronger and well-established companies, which tend to have lower credit risk. In other words, the market is currently renewed with characteristics that can enhance the overall risk-return profile of the asset class. This trend should accelerate, in our view, with an emphasis on liability management and discussions around lowering the cost of debt.

M&A remains a prominent theme, and we expect activity affecting convertible bond issuers to remain robust because innovation encourages industry consolidation. It is important to remember that convertible bond holders generally benefit from some form of takeover protection through the ‘ratchet clause’ or the ‘redemption put at par’. A simple rumour can richen the convertible price to levels reflecting a higher probability of a change of control.

The buyback of convertibles by issuers at a premium to the current market price but below face value and before the maturity date is a rising tailwind for the asset class. We anticipate firms that engage in debt buybacks will also see an improvement in their financial metrics, which should boost investor confidence.

Convertible bonds’ underlying equities provide some catch-up potential and diversification benefits as a large proportion of issuers often have no other debt instruments and they provide exposure to important secular trends serving large addressable markets.

Valuations are currently at attractive absolute levels and provide, in our view, an entry point to capitalise on the convexity feature, which should attract interest from a new wave of asset allocators.

These seven tailwinds should make convexity great again. We believe that convertible bonds currently provide a natural defensive alternative to equities for capturing the outperformance on any downside that may come.

Continuer vers