Convertible Bonds

Issuers bargain hunt their own discounted convertibles

Convertible Bonds

Apart from generating meaningful savings, we think companies are looking to optimise the capital structure, or simply avoid negative rumours about their prospects. Additionally, we've heard that some companies are looking to extend their debt maturities in order to avoid a significant rise in refinancing rates and get ahead of the maturity wall.

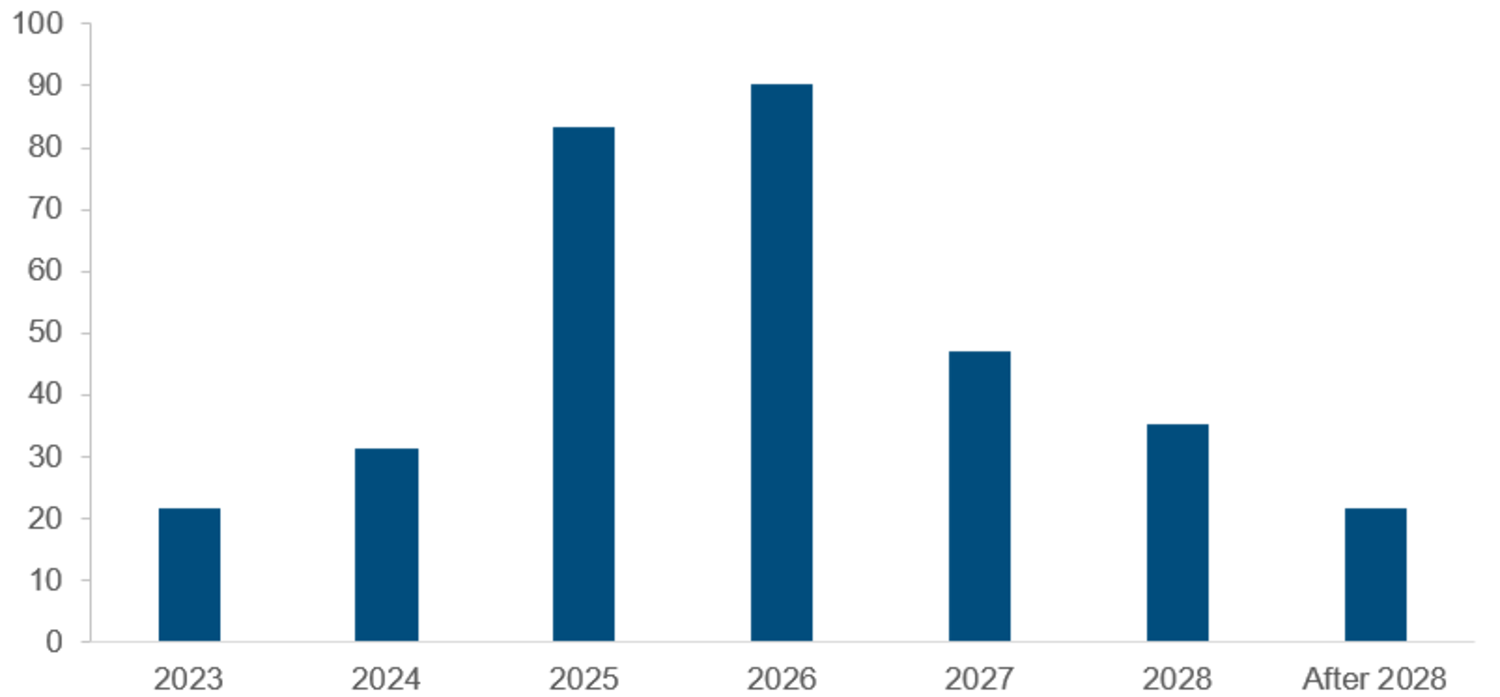

As illustrated in chart 1, a growing number of convertible note issuers must deal with future maturities given that USD175 billion globally is set to retire in 2025/2026. According to Bank of America Research, it likely explains why the average number of years before a maturity is claimed has increased to 2.6 globally, an 8-year high, indicating that CBs have been repaid earlier than in the past.

Source: BofA, Mirabaud Asset Management, 31 May 2023

We believe that lowering the amount of debt outstanding may help the company's creditworthiness, and bondholders may gain from a yield improvement if bond prices rise. We anticipate firms that engage in debt buybacks will also see an improvement in their financial metrics. This in turn should boost investor confidence and draw more attention to the business's securities, which could lead to a rise in the price of those assets.

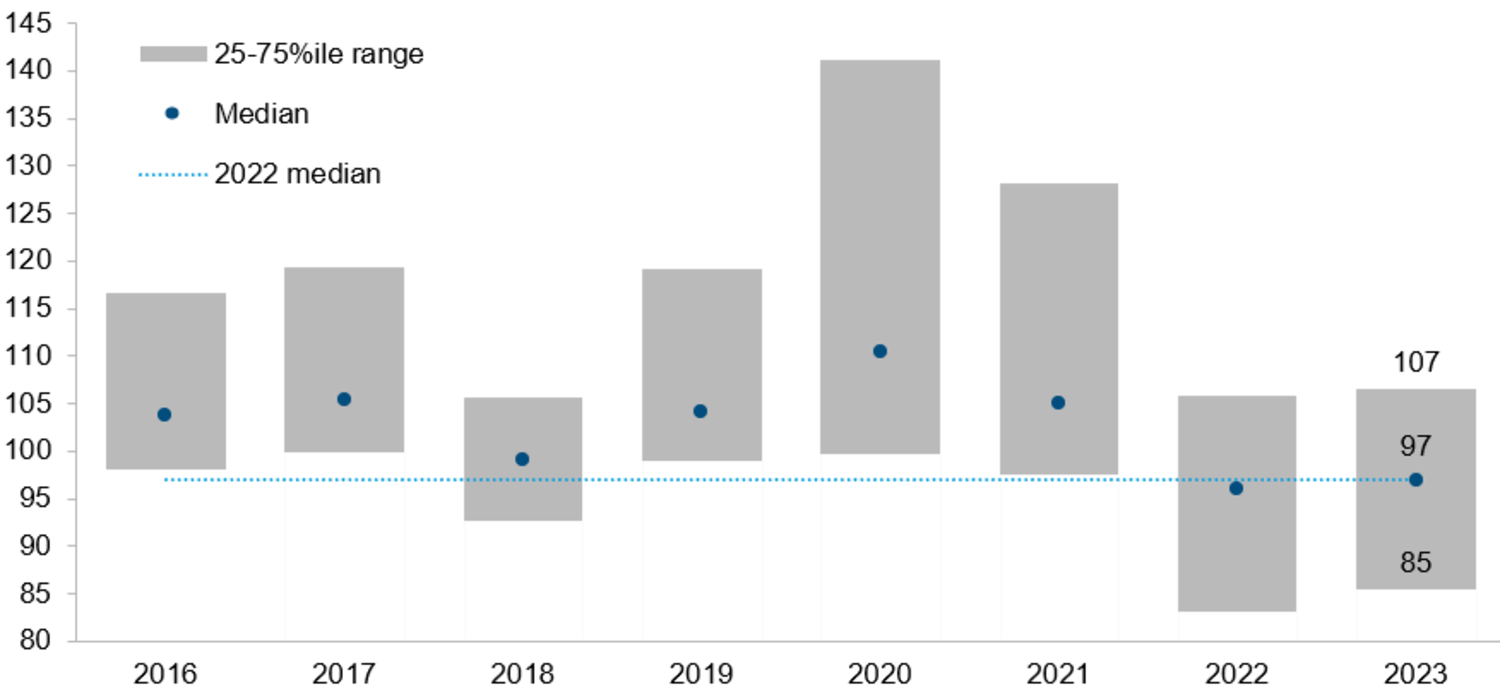

As shown in chart 2, declining prices of outstanding convertible notes have made it possible for companies to consider debt repurchases, with the current median price of global CBs at just 97% – its lowest since 2016, while 25% of CBs are trading below 85%.

Source: BofA, Mirabaud Asset Management, 28 April 2023

We think businesses with strong financial performance and a promising future may be more likely to repurchase their convertible bonds. Convertibles, however, can also have more appealing buyback potential if they have substantial conversion premiums, or are currently trading at values that are below their historical averages. Additionally, when a bond's maturity date or a large redemption date is approaching, issuers are frequently motivated to repurchase the bond.

Companies must abide by all applicable securities laws and rules, including those imposed by the US Securities and Exchange Commission, or equivalent regulatory authorities in other countries. A press announcement or an updated disclosure in the issuer's periodic reports may be required as part of these laws' disclosure duties for repurchasing convertible bonds. If an issuer plans to launch a debt repurchase programme, this information should be reported beforehand due to the programme's scope or other characteristics.

The US has been the busiest region year-to-date with around 20 buybacks. Most have been paid in cash through privately negotiated transactions with a limited number of holders. Among the most active firms are Chegg, Fastly, Bandwith, LivePerson, Opendoor Technologies, Pegasystems, Q2 Holdings, Redfin, RingCentral and Upwork.

They can also be structured as an exchange, in which holders that tender their notes receive new convertible notes for their existing ones, like the recent transactions brought by Delivery Hero or RAG/Evonik in Germany.

It is also very common in Hong Kong for an issuer to repurchase debt that is available in the open market through a broker-dealer, in an efficient and effective manner that does not generally constitute a tender offer. Recent examples include China Yuha Education, Weimob and Zhou Hei Ya.

Finally, a tender offer must sometimes be made to all bondholders to tender their bonds for sale at a specified price over a fixed period, subject to specified conditions. We saw MorphoSys do this via a modified reverse Dutch auction procedure earlier this year.

In conclusion, we believe CB repurchase can be an effective use of an issuer's surplus cash, depending on the degree of the discount and the other possible uses for that liquidity. It is crucial to remember that generating alpha from debt buybacks depends on the state of the market, company-specific factors, and the capacity to recognise opportunities.

Continuer vers