Convertible Bonds

Minimising judgement risk in convertible bonds

Convertible Bonds

Short-term market timing is a dangerous strategy. Investors often react emotionally to risk asset swings, leading to poor decision-making. For every investor who successfully times the market to buy low and sell high, there's another on the other side of the trade who gets it wrong. In this context, we believe that convertible bonds should be considered a strategic investment rather than a tactical one for two reasons.

Convertibles typically provide a greater degree of outperformance during market downturns than underperformance during market upturns, making them a useful diversification tool over a full cycle for investors looking to improve a portfolio’s risk profile.

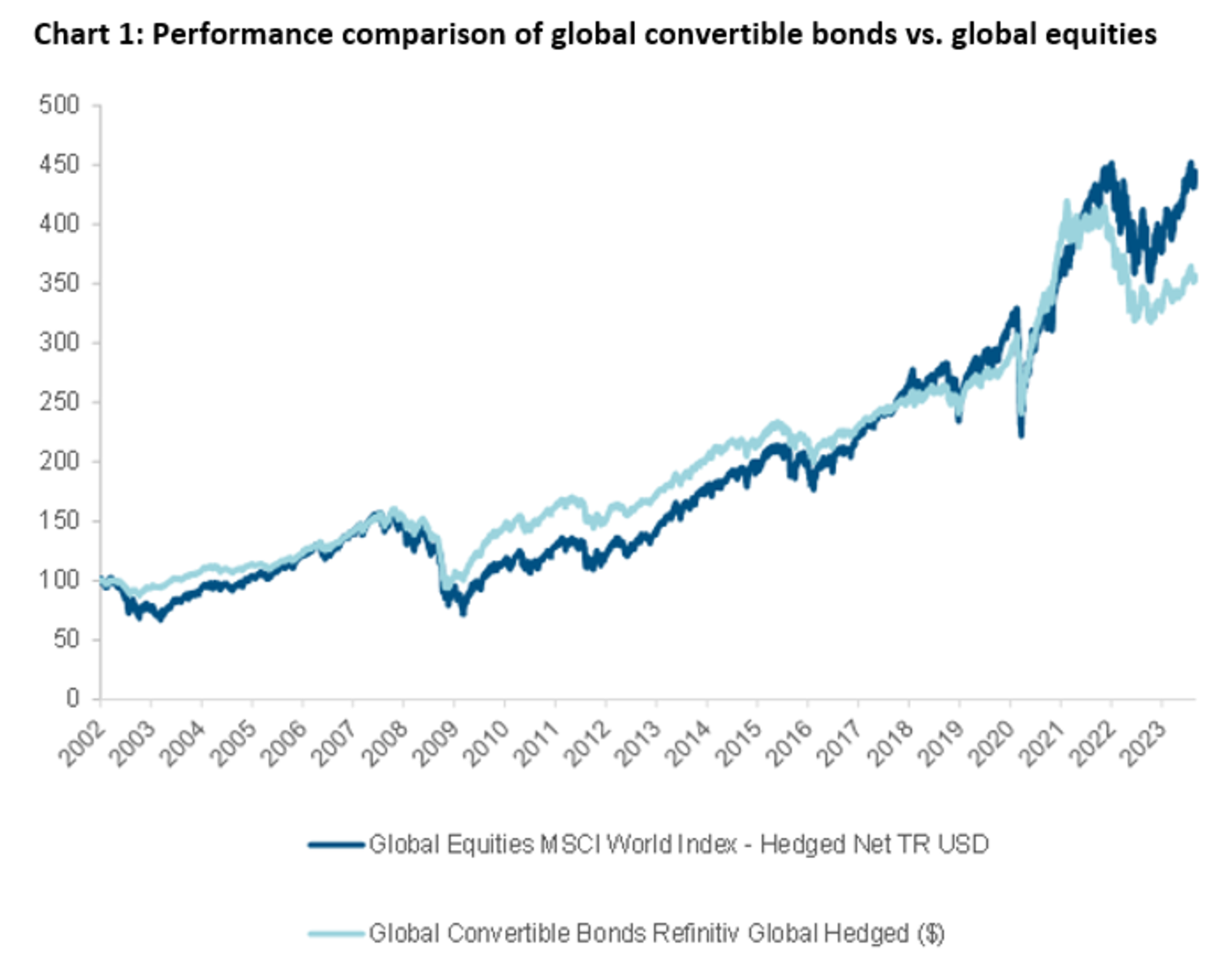

To illustrate, chart 1 shows that over a long time horizon (31/12/2001 to 31/08/2023), global convertible bonds offer similar returns to global equities (6% annually vs. 7.1%), with 88% correlation and half the volatility (8% vs. 15.6%).

Source: Mirabaud Asset Management, Refinitiv, Bloomberg, as of 31 July 2023. Past performance is not indicative or a guarantee of future returns. Indices are not available for direct investment.

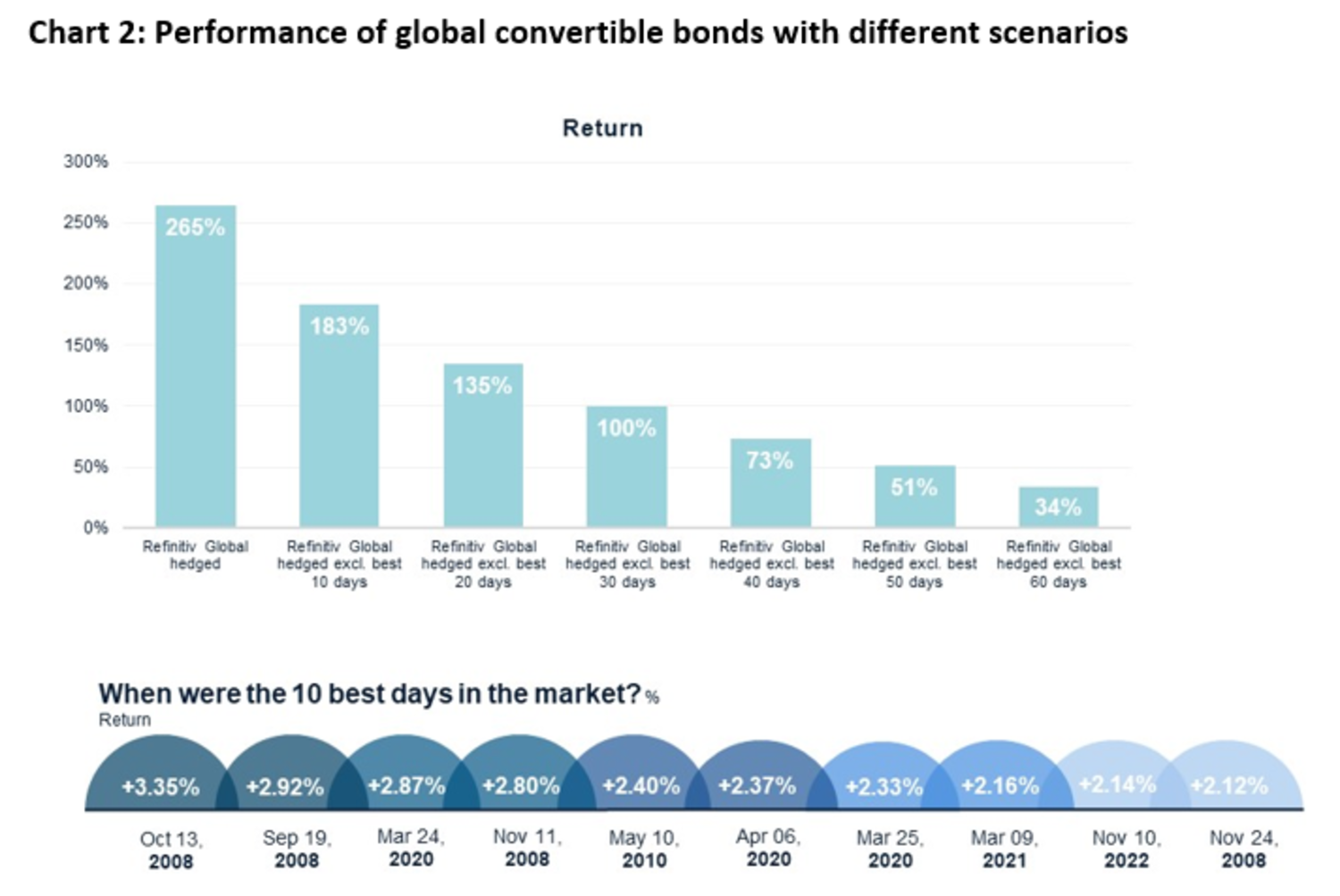

Tactically investing in convertibles leaves you exposed to the danger of missing out on the market's greatest days. Chart 2 highlights the consequences of skipping in and out compared to following a long-term investment strategy. If an investor stayed fully invested across the period, their initial investment would have generated a return of 265%, as opposed to 183% if they missed the market's 10 best days.

One of the reasons for this significant disparity is the best days frequently occur during periods of market turmoil and elevated volatility, as shown in the table.

Source: Mirabaud and Bloomberg as of 31 July 2023. Refinitiv Global Hedged in USD.Refinitiv Index is powered by Refinitiv data and calculated by Refinitiv. Past performance is not indicative or a guarantee of future returns.

We believe convertible bonds provide the tools to navigate volatile markets, stay engaged through market cycles and achieve long-term rewards.

In our view, having a 5%–10% allocation to convertibles in a balanced portfolio (depending on investors’ appetites and existing portfolio structures) maximises the risk-adjusted return (Sharpe ratio). But to fully benefit from the merits offered by the asset class, history shows that it is best to remain invested and avoid letting emotions influence your investment choices.

Continuer vers