Fixed Income

In basic terms, successful investing means populating a portfolio with a great selection of securities. For active managers like ourselves, making the right credit calls comes from conducting deep research to analyse corporates across the global fixed income universe, where we look for strong, sustainable opportunities to build high-conviction portfolios. This is classic bottom-up investing.

But at almost USD100 trillion in size1, the global bond universe is a vast place to search for potential superstar securities. Implementing a top-down approach helps to apply our worldview to the investment universe and distil it down, honing where we look for opportunities across geographies, sectors and tenures.

Historically, when markets moved in more predictable cycles, our top-down view held less weight in the investment process. Bar the occasional black swan event, we roughly knew where markets were likely to be going and how economic cycles were shifting. But in the last few years, the macro environment has radically changed.

When the Federal Reserve began to lift interest rates out of 0% territory in March 2022, the hikes came at unprecedented speed in an effort to dampen inflation. Across fixed income markets, this caused positive correlations between rates and spreads for an unusually extended period. Dispersion also reduced, as most bonds moved with their duration and rating, rather than being driven by credit fundamentals and spread.

In this environment, having the right top-down view outweighed good bottom-up calls. Markets were so focused on inflation and the timing of the next rate hike that solid fundamentals only got you so far, as each data release set the tone for the day’s trading. Now, over two years on, uncertainty remains as to whether we will see a no landing or a soft landing, when rate cuts will come and how many we can count on for 2024.

So, does top-down still outweigh bottom-up?

We now have a situation where both matter. Detailed bottom-up analysis is very important, as we are starting to see the cracks appear, both from softer economic activity feeding into earnings, and from ‘higher for longer’ funding costs pushing issuers closer to their maturity walls. Notably, we have seen several large broken capital structures this year. Conversely, top-down remains influential because data-point uncertainty continues to drive volatility.

Over the past three years or so, top-down has been the more dominant influence, at around a 60/40 or 70/30 weighting, but today the balance is closer to 50/50. As we move into a new phase of the economic cycle, bottom-up factors should increase in importance – either we head towards a hard landing, where our focus will be on picking the survivors, or we begin a new cycle, where we’ll target the recovery trade and ratings upgrades.

To combine the two influences in our investment process, we employ a proprietary macro framework to identify the economic environment within which we are operating and set our risk appetite across geographies. We identify the sectors that we think will outperform in that environment and those that we should avoid/reduce. This takes us to the bottom-up phase of the process, which we use to populate our sector selections with companies that we believe will perform inline or better than their sector.

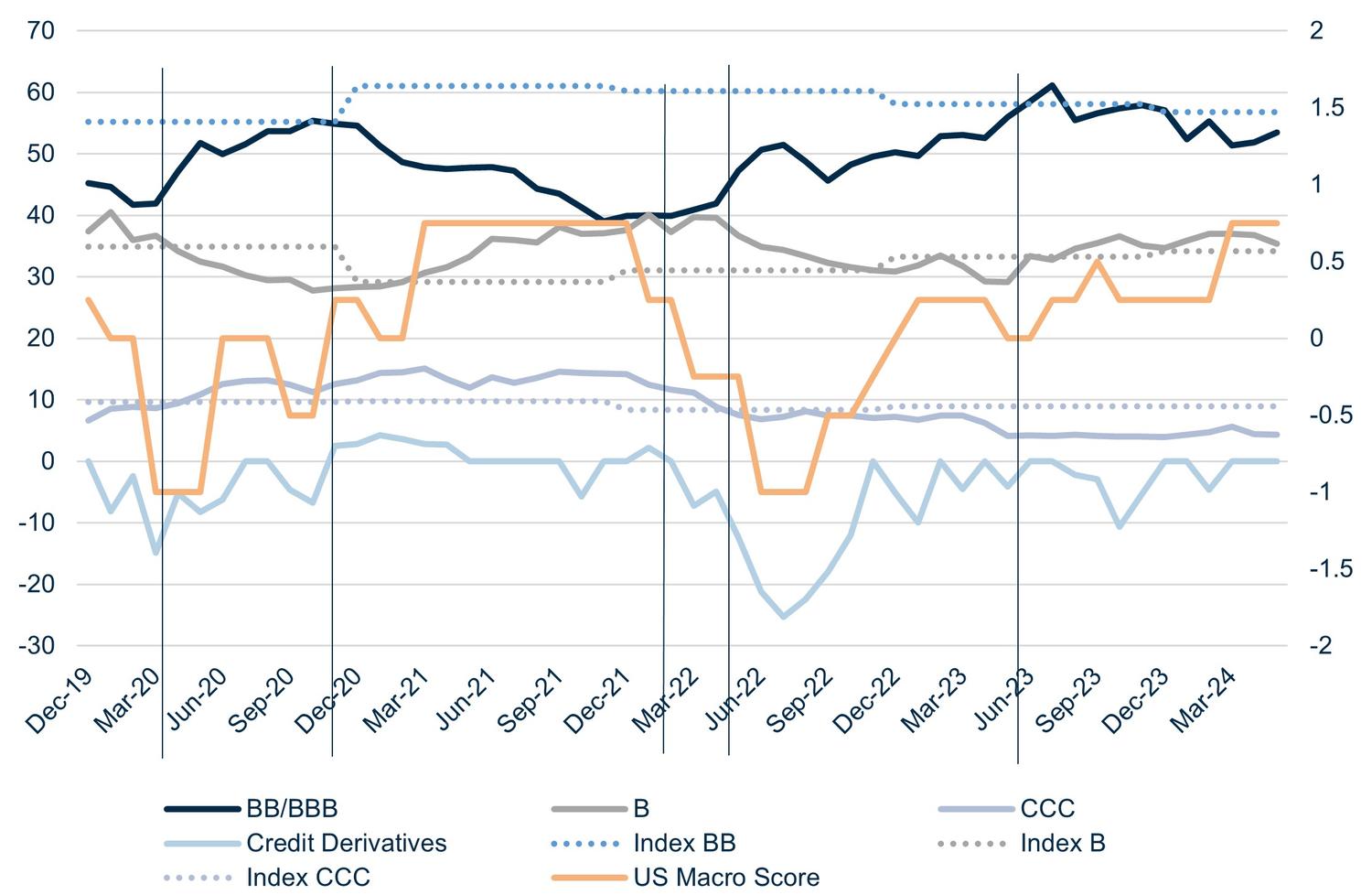

To illustrate, the chart below shows the relationship between our top-down view and the positioning of our global high yield portfolio over the past three years, using macro score and ratings allocation. As the macro score (orange line) goes down, we increase quality by increasing BB exposure and reducing B and CCC overweights. Conversely, when the macro score goes up, we reduce BB (both to take more credit risk and reduce duration) and increase B/CCC. Top-down drives bottom-up, but they both have an important role to play.

The unprecedented rates environment and data-reliance of today’s economy mean you can’t set a macro view at the beginning of the year for the coming 12 months and trade based on bottom-up fundamentals alone. Getting the macro wrong can result in losses that far outweigh any positive credit selection. Our macro-outlook thus evolves over time given the backdrop. We believe a blended, flexible top-down/bottom-up investment style is essential for success.

1 OECD Global Debt Report 2024

Continuer vers